- Complexity of billing: The distinction between KVG/LAMal and VVG/LCA benefits for hospital treatment requires clear separations.

- FINMA regulations: protection by tariff regulations (Art. 44 KVG/LAMal) and strict regulations concerning the delimitation of benefits complicate the process.

- Time-consuming administration: doctors often have to deal with requests for information about fees and reimbursements.

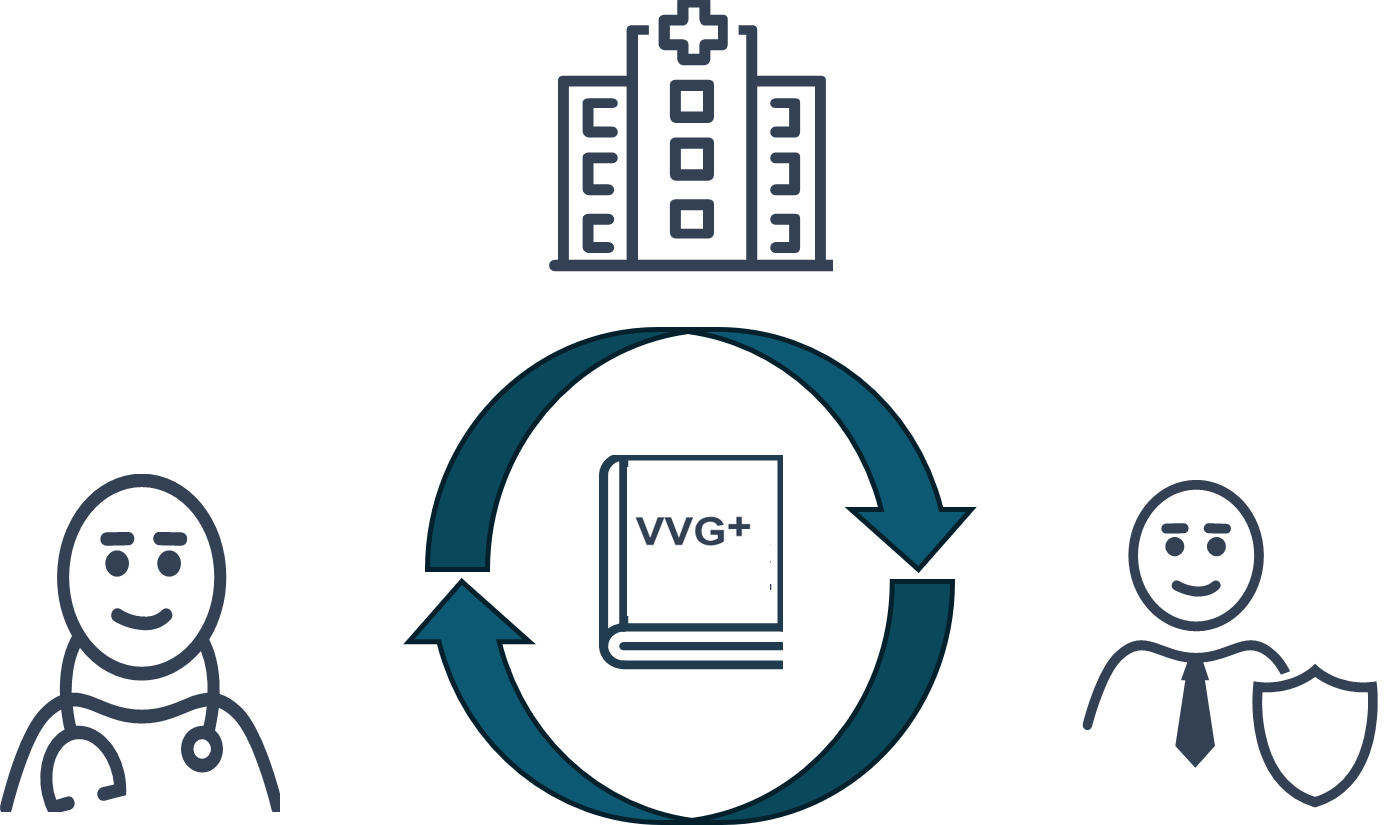

VVG+

The Insurance Contracts Act (VVG) governs benefits and reimbursements that go beyond compulsory health insurance. Since 2022, calculation models that pay only for medical added value have been mandatory in order to ensure transparency of the costs attributable to VVG insurance.

The Swiss billing system

The Swiss healthcare system is characterised by a combination of compulsory health insurance (KVG/LAMal/LAA/AI/AMF) and additional private or semi-private insurance cover (LCA). This system gives patients access to medical services, comfort, rapid treatment and a choice of provider, but poses challenges for doctors in terms of correct and efficient billing.

VVG+: a solution for efficiency and transparency

The VVG+ fee structure has been developed to comply with FINMA requirements aimed at separating the portion of medical fees covered by social insurance (KVG/LAMal) from that corresponding to the «added value» linked to supplementary insurance benefits (VVG/LCA). Based on data collected by Swiss Medical Network (SMN), VVG+ establishes a weighted average of fees by pathology and DRG. This structure makes it possible to bill added value in the form of points, leaving doctors free to negotiate the value of these points. Adapted each year, VVG+ guarantees dynamic pricing in line with medical developments.

VVG+ a rate structure: What makes it special?

Key features of VVG+

- Data collection and integration. VVG+ was developed on the basis of empirical billing of private fees from several establishments and several cantons.

- Automated invoicing: Invoices are sent electronically and quickly to the insurers concerned.

- Clear allocation of costs: The structure makes it possible to remunerate both the portion of fees included in the fixed fee payable by social insurance and the added value of the VVG.

A typical VVG+ procedure

- Invoicing: On receipt of the operative report and discharge letter, the hospital codes the stay in order to allocate a SwissDRG lump sum to the case.

- Control: The system automatically allocates the share of the social fee to the operating doctor, anaesthetist and/or assistant and automatically invoices the medical added value for each doctor.

- Payment: The establishment's invoice and the medical fee are sent directly to the insurance company for payment. This structure simplifies checks with the insurer and optimises the speed of payment to the doctor.